In the ever-evolving world of cryptocurrencies, Dogecoin has captured the imagination of investors and miners alike, transforming from a meme-inspired joke into a legitimate digital asset with real potential. For South African buyers eyeing the mining scene, understanding the nuances of Dogecoin mining machines is crucial. These devices, often specialized GPUs or ASICs, are the backbone of crypto extraction, allowing users to validate transactions and earn rewards. But with options ranging from budget-friendly rigs to high-end models, how do you choose? This article dives into comparisons, weaving in insights on Bitcoin, Ethereum, and the broader ecosystem of mining farms and hosting services to paint a fuller picture.

Let’s start with the basics: Dogecoin mining relies on a proof-of-work algorithm similar to Bitcoin’s, though it’s less intensive, making it accessible for newcomers. In South Africa, where electricity costs and internet reliability vary, selecting the right machine means balancing efficiency, cost, and longevity. Take, for instance, the popular Antminer series—models like the L3+ are tailored for Scrypt-based coins like Dogecoin. They boast hash rates up to 504 MH/s, consuming around 800 watts, which could yield substantial returns if electricity prices remain stable. Contrast this with Ethereum’s shift to proof-of-stake, which has miners scrambling to adapt, potentially freeing up GPU rigs for Dogecoin or other alternatives.

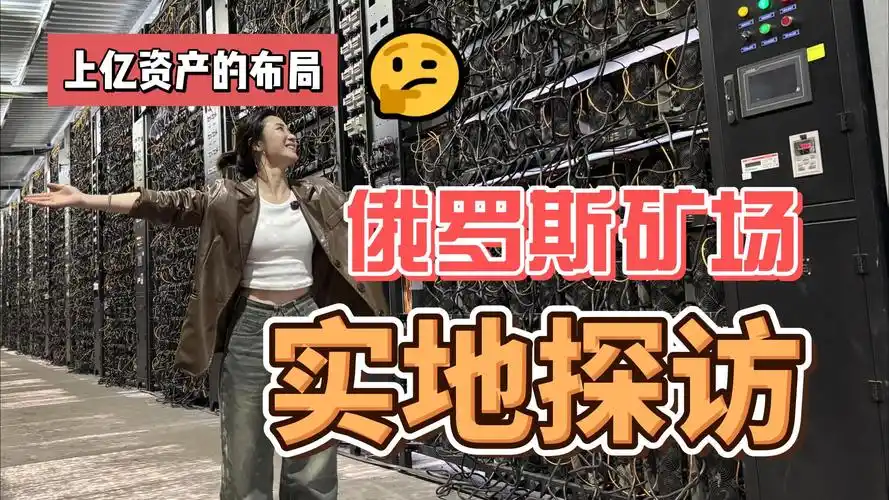

Now, imagine a bustling mining farm in Johannesburg, where rows of these machines hum in unison, hosted by services that handle the heavy lifting. For South African buyers, hosting options from companies specializing in crypto infrastructure can be a game-changer. Instead of dealing with the noise, heat, and power demands at home, you could opt for a hosted solution where your mining rig operates in a controlled environment. This not only reduces operational headaches but also taps into pooled resources, much like Bitcoin’s network, where collective power enhances security and profitability. Yet, the choice isn’t straightforward; factors like local regulations, import taxes, and currency fluctuations—such as the rand’s volatility against the dollar—add layers of complexity.

Comparing Dogecoin-specific miners to general-purpose ones reveals intriguing differences. While a Bitcoin ASIC like the Whatsminer M30S focuses on SHA-256 hashing, Dogecoin machines prioritize Scrypt, leading to variations in performance and energy use. In South Africa, where power outages are common, opting for a more resilient miner could mean the difference between profit and loss. Enter the world of hybrid rigs that support multiple algorithms, allowing seamless switches between Dogecoin, Litecoin, or even emerging coins. This versatility echoes the adaptability seen in Ethereum’s ecosystem, where miners once used GPUs for both gaming and crypto before the network’s upgrade.

But burst forth with the realities: not all machines are created equal. A basic USB miner might suit hobbyists, offering low hash rates and minimal setup, yet it’s worlds away from industrial-grade options that dominate large-scale operations. For South African buyers, affordability is key—importing a high-end rig could incur hefty customs fees, pushing costs up by 20-30%. That’s where local distributors shine, providing tailored advice and even hosting partnerships. Picture this: you purchase a mining rig, have it hosted at a secure facility, and monitor it via an app, all while the machine quietly contributes to the Dogecoin blockchain.

Delving deeper, let’s not overlook the environmental angle. With global scrutiny on crypto’s carbon footprint, South African miners must consider green alternatives. Solar-powered hosting farms, for example, could offset the energy demands of Dogecoin mining, aligning with sustainable practices seen in Bitcoin’s renewable energy push. Exchanges like Binance or Luno, popular in the region, facilitate the conversion of mined coins to fiat, but they also highlight market volatility—Dogecoin’s price can swing wildly, turning a profitable setup into a loss overnight. Thus, diversification is essential; pairing Dogecoin mining with stakes in Ethereum or stablecoins might mitigate risks.

In this unpredictable landscape, the right mining machine becomes a strategic asset. For South Africans, factors like the rand’s exchange rate against Bitcoin or the availability of spare parts for repairs add to the decision-making process. Whether you’re a solo miner or part of a collective farm, understanding these elements ensures you’re not just chasing memes but building a resilient operation. As the crypto world races forward, armed with knowledge, South African buyers can navigate the Dogecoin mining maze with confidence and creativity.

Ultimately, the thrill of mining Dogecoin lies in its community-driven spirit, much like the early days of Ethereum’s decentralized ethos. By weighing the pros and cons of different machines, considering hosting options, and staying informed on broader trends, South African enthusiasts can turn their investments into rewarding ventures. Remember, in the world of crypto, adaptability isn’t just an advantage—it’s a necessity.

This article offers a comprehensive overview of Dogecoin mining machines tailored for South African buyers. It highlights key features, performance metrics, and cost-efficiency comparisons. The insights into local availability and delivery options further equip potential miners with the necessary knowledge to make informed decisions in a rapidly evolving cryptocurrency landscape.